Ensuring accuracy and efficiency is critical when it comes to managing a healthcare practice’s medical accounting. Small errors lead to long delays and impact the available cash flow for the practice. It upsets patients and limits the success of any business over the long term.

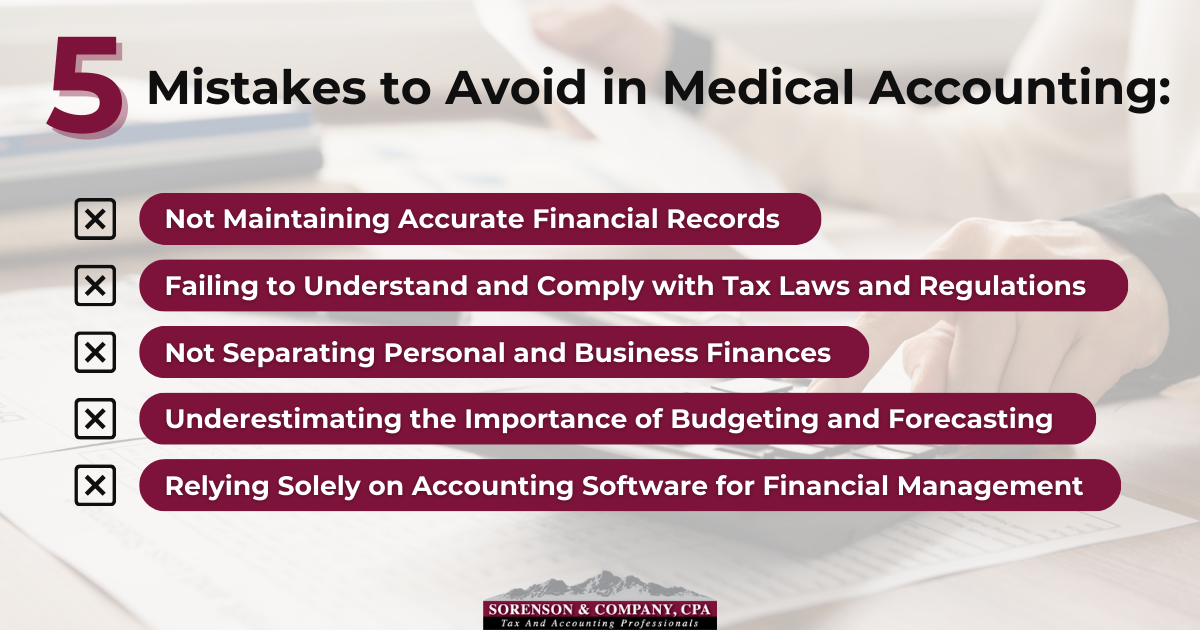

Avoiding the following five common mistakes in medical accounting could lead to better, more efficient practices.

Mistake #1: Not Maintaining Accurate Financial Records

Poor maintenance of financial records minimizes a practice’s ability to stay on top of the financial health of the organization. The consequences of poor record-keeping often include:

- Missed payments

- Lost revenue

- Frustrated employees and other stakeholders

Improving record-keeping at any level minimizes losses. To do this, start by:

- Creating sound medical record-keeping procedures to use office-wide

- Ensure employees have ample training in the importance of medical record keeping and procedures

- Ensure labeling is consistent and done readily

- Automate any processes you can

- Improve data security to minimize risks

Mistake #2: Failing to Understand and Comply with Tax Laws and Regulations

All healthcare practices must navigate the complexity that often comes from tax laws and regulations. There is no better way to stay up to date on these strategies than to hire an experienced accountant to help with tax management.

Some common mistakes include:

- Not maximizing retirement contributions

- Not taking all eligible donations

- Classifying the business incorrectly

While all practice leadership should have some understanding of the revenue and tax requirements, it is often the furthest from a doctor’s mind when caring for patients. Yet, staying up-to-date, including monitoring the IRS website for updates, can help avoid challenges.

Mistake #3: Not Separating Personal and Business Finances

All finances for the practice must be separate from personal expenses. From the start, practice owners must create separate business checking accounts to manage both income and expenses. Mingling personal and business funds clouds the line of liability. Should a creditor try to seek a claim against your practice, and mingling of finances like this is occurring, it could put personal assets at risk.

Consider the following tips:

- Create separate business and savings accounts

- Set up payroll to pay all parties within the business for the services provided

- Establish a business credit card for business-related purchases

- Ensure separate accounts are in place for each practice location

- Talk with an accountant about any current combination of personal and business expenses

Mistake #4: Underestimating the Importance of Budgeting and Forecasting

Businesses need to keep a close and consistent eye on cash flow, the money coming in and the money going out. While monitoring cash flow is essential, so is having an accurate budget to follow.

Your budget should be based on forecasting, a process that looks at the expected revenue of the organization over a set period of time. Without a budget and some idea of what your company’s financial health is at any given time, your practice cannot adequately grow.

With this insight, companies know what’s helping them to become profitable and what opportunities exist for potential improvement.

Some key aspects to keep in mind here include:

- Utilize automation and software to help streamline budgets

- Create an accurate budget based on real expenses

- Set realistic objectives

- Ensure that any profit and practice growth is based on accurate data and analysis

- Factor in unforeseen challenges and requirements

- Work with an accountant to structure a budget based specifically on your organization

Mistake #5: Relying Solely on Accounting Software for Financial Management

Software is one component of creating sound financial management, but it does not replace the work, insight, and guidance that a full-service solution offers.

Many practices fall victim to using a simple-to-use software tool that offers only as much information as you feed into it. It cannot take that data and provide guidance or ensure accuracy, especially if errors are present or the data isn’t complete.

Consider these best practices for using accounting software alongside other tools:

- Ensure strategies are in place to pinpoint areas of risk – such as conducting routine audits to ensure data is complete and accurate

- Utilize the most up-to-date resources, which often means updating software consistently to ensure security, data accuracy, and program reliability

- Utilize experts who can provide insights and resources to help practices with growth projections, analysis, and challenge management

Having a team of professionals who can oversee the company’s medical accounting allows you to harness your software in the most effective way possible.

Don’t Overlook Your Medical Accounting

Your medical accounting is one of the core operational components of running your practice. Ensure that you are staying up to date not only on business best practices and IRS changes but also on the use of:

- Automation

- Accounting software

- New insights into the industry

Accurate, effective financial management is the only way to structure and build a business model that lasts.

Your medical practice needs support as it grows and expands throughout this process. Sorenson & Company, CPA, can help by providing insight, guidance, support, and solutions to your biggest operational challenges. Contact us now to learn how.