The healthcare industry is complex, which means ensuring strong accounting practices are in place can help by providing clarity and stability in a practice.

It’s a good time of year to take stock of your accounting practices and see if there are any areas for improvement. Here are some fundamental tips to strengthen your practice’s medical accounting.

1. Meticulous Cost Accounting

Understanding your costs is key to making informed financial decisions. In the complex healthcare landscape, where expenses can quickly escalate, meticulous cost accounting is not just a best practice; it’s a necessity.

By accurately tracking and categorizing costs, you gain invaluable insights into your financial health, identify areas for potential savings, and make data-driven decisions that directly impact your bottom line.

Best Practices for Cost Accounting

- Monitor and analyze cost trends: Regularly compare actual costs against budgeted figures to identify variances and take corrective actions.

- Consider Activity-Based Costing (ABC): Traditional cost accounting methods often use broad allocations that may not accurately reflect the actual resources used by each service. ABC assigns costs based on the specific activities that drive them, providing a more accurate picture of cost per procedure or service.

- Track Costs by Department and Service Line: Go beyond general categories. Allocate costs to specific departments (e.g., primary care, specialty care, lab services, administrative services) and service lines (e.g., office visits, lab tests, imaging, chronic disease management). This will provide granular insights into cost drivers and profitability by area.

- Factor in Indirect Costs: Don’t overlook indirect costs like utilities, administrative salaries, and facility maintenance. These can significantly impact overall profitability. Allocate these costs fairly across departments and services.

- Regularly Review and Update Cost Standards: As prices for supplies, labor, and other resources fluctuate, so should your cost standards. Regularly update these benchmarks to ensure your financial analysis is based on current data.

2. Accurate and Timely Revenue Cycle Management

The revenue cycle is the lifeblood of any healthcare organization.

It encompasses everything from patient registration and insurance verification to claim submission, billing, and collections. Efficient management of this cycle ensures that your organization receives timely payments, minimizes bad debt, and maintains a healthy cash flow.

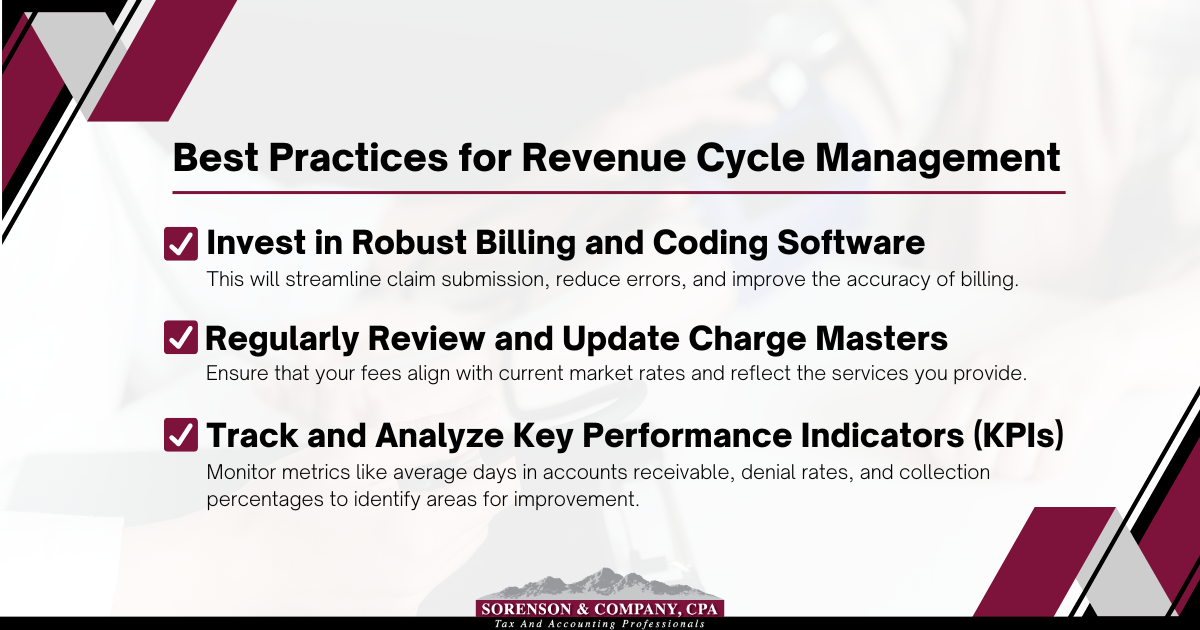

Best Practices for Revenue Cycle Management

- Invest in robust billing and coding software: This will streamline claim submission, reduce errors, and improve the accuracy of billing.

- Regularly review and update charge masters: Ensure that your fees align with current market rates and reflect the services you provide.

- Track and analyze key performance indicators (KPIs): Monitor metrics like average days in accounts receivable, denial rates, and collection percentages to identify areas for improvement.

3. Strategic Financial Planning and Analysis

Financial planning and analysis provide the roadmap for your organization’s financial future.

Create a comprehensive budget that aligns with your strategic goals, and regularly review and update it based on actual performance.

Best Practices in Strategic Financial Planning and Analysis

- Conduct regular financial forecasts: Anticipate future financial needs and challenges to make proactive decisions.

- Analyze financial performance against benchmarks: Compare your organization’s financial metrics with industry averages to gauge your performance and identify areas for improvement.

- Tie your financials to your KPIs: Ensure you’re working towards goals that matter specifically to your practice.

4. Cash Flow Management

Cash flow management is crucial for maintaining the financial health of your healthcare organization. It includes monitoring and controlling the inflow and outflow of cash to ensure that you have sufficient funds to meet your ongoing financial obligations.

Even if your practice is profitable on paper, without proper cash flow management, it may not be able to meet its obligations.

Best Practices in Cash Flow Management

- Implement cash flow forecasting: Predict your future cash flow needs to make informed decisions about budgeting, borrowing, and investing.

- Monitor key cash flow metrics: Track metrics like net cash flow, operating cash flow, and free cash flow to assess your financial health and identify areas for improvement.

- Implement strategies to improve cash flow: This may include negotiating longer payment terms with suppliers, collecting payments from patients more efficiently, and reducing unnecessary expenses.

5. Compliance with Regulatory Requirements

The healthcare industry is subject to many regulations impacting your finances, such as HIPAA, the Affordable Care Act (ACA), and various state-specific laws.

Ensure your medical practice complies with all applicable regulations to avoid penalties and maintain the integrity of your financial records. This includes staying informed of regulatory changes, and maintaining thorough financial and other documentation. Information needs to be stored securely, whether online or in paper files.

6. Partner with a Specialized Medical Accounting Firm

Healthcare accounting is complex and often requires specialized knowledge. Save money by working with Sorenson & Company CPA, we specialize in working with healthcare practices of all sizes.

We can provide the expertise and guidance you need to navigate the intricacies of healthcare accounting, tax planning, ensuring compliance, accuracy, and financial success.

You don’t need to be an expert in medical accounting – that’s our job!

Contact Sorenson & Company CPA today to make managing your practice’s finances easier.