When it comes to medical bookkeeping, it’s easy for health professionals to focus fully on the medical practice and forget about the finances. While patients are the top priority, failing to pay attention to bookkeeping can have many pitfalls.

We’ve previously written about common accounting mistakes in medical practices. However, there are many more bookkeeping mistakes that we would like to help more practices to avoid.

Medical Bookkeeping Mistake # 1: Inaccurate Patient Billing

Inaccurate patient billing can be a major headache for both medical practices and patients. Here’s a closer look at this common medical bookkeeping mistake and how to avoid it.

Consequences of Inaccurate Patient Billing

- Lost Revenue: Denied claims due to billing errors can significantly impact a practice’s income.

- Frustrated Patients: Receiving incorrect bills or unexpected charges can lead to patient dissatisfaction and damage the practice’s reputation.

- Audits: If inaccurate billing becomes a recurring issue, it can trigger audits from insurance companies or government agencies.

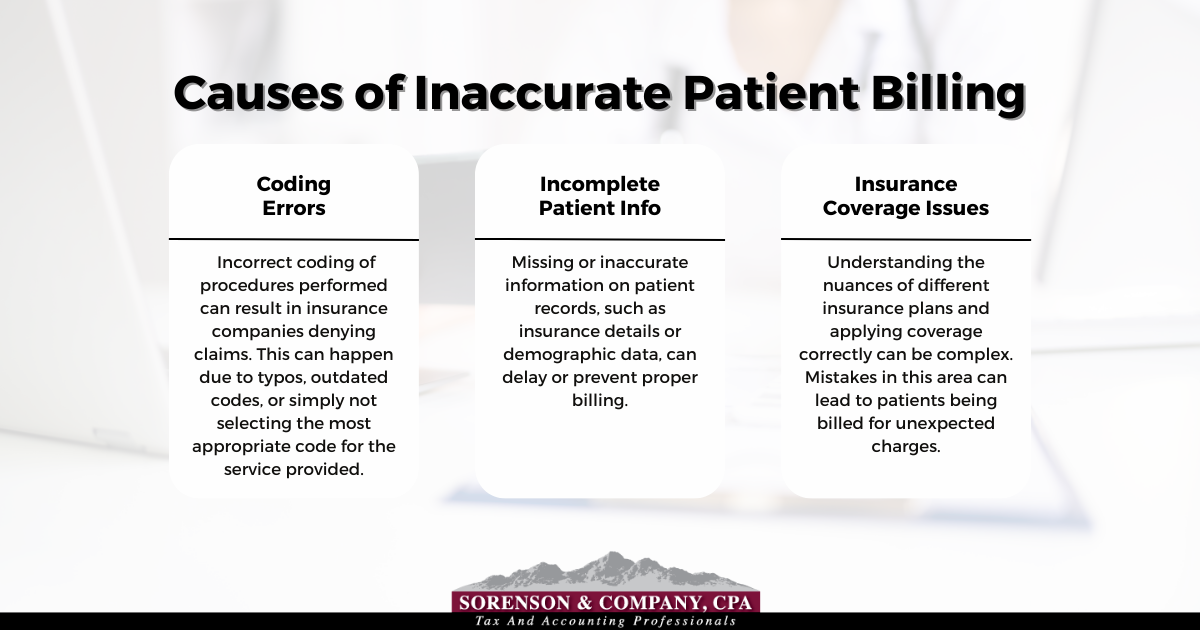

Causes of Inaccurate Patient Billing

- Coding Errors: Incorrect coding of procedures performed can result in insurance companies denying claims. This can happen due to typos, outdated codes, or simply not selecting the most appropriate code for the service provided.

- Incomplete Patient Information: Missing or inaccurate information on patient records, such as insurance details or demographic data, can delay or prevent proper billing.

- Insurance Coverage Issues: Understanding the nuances of different insurance plans and applying coverage correctly can be complex. Mistakes in this area can lead to patients being billed for unexpected charges.

Best Practices for Accurate Billing

- Invest in Qualified Medical Coders and Training: Proper coding is critical for accurate billing. Hiring qualified medical coders who stay updated on coding regulations can significantly reduce errors.

- Ensure Accurate and Complete Patient Information: Develop a system to verify and update patient information regularly. This includes insurance details, demographics, and any changes in coverage.

- Regularly Review and Update Billing Processes: Stay informed about changes in insurance regulations and billing practices. Conduct periodic reviews of your billing procedures to identify and address any potential issues.

Medical Bookkeeping Mistake # 2: Neglecting Bank Reconciliations

Bank reconciliation involves comparing your bank statement to your internal accounting records. This process ensures that all recorded transactions (deposits, withdrawals, checks written) match the activity reflected in your bank account.

Regular bank reconciliations are a crucial step in maintaining accurate financial records for any business, and medical practices are no exception. Skipping this process can lead to missed errors, potential fraud, and difficulty tracking the true financial health of the practice.

Benefits of Regular Reconciliations:

- Early Error Detection: Regular reconciliation allows practices to catch errors quickly and address them before they become bigger problems.

- Improved Cash Flow Management: Accurate financial records provide a clear picture of your cash flow, making it easier to manage expenses and plan for future needs.

- Peace of Mind: Knowing your financial records are accurate gives you peace of mind and allows you to focus on running your practice effectively.

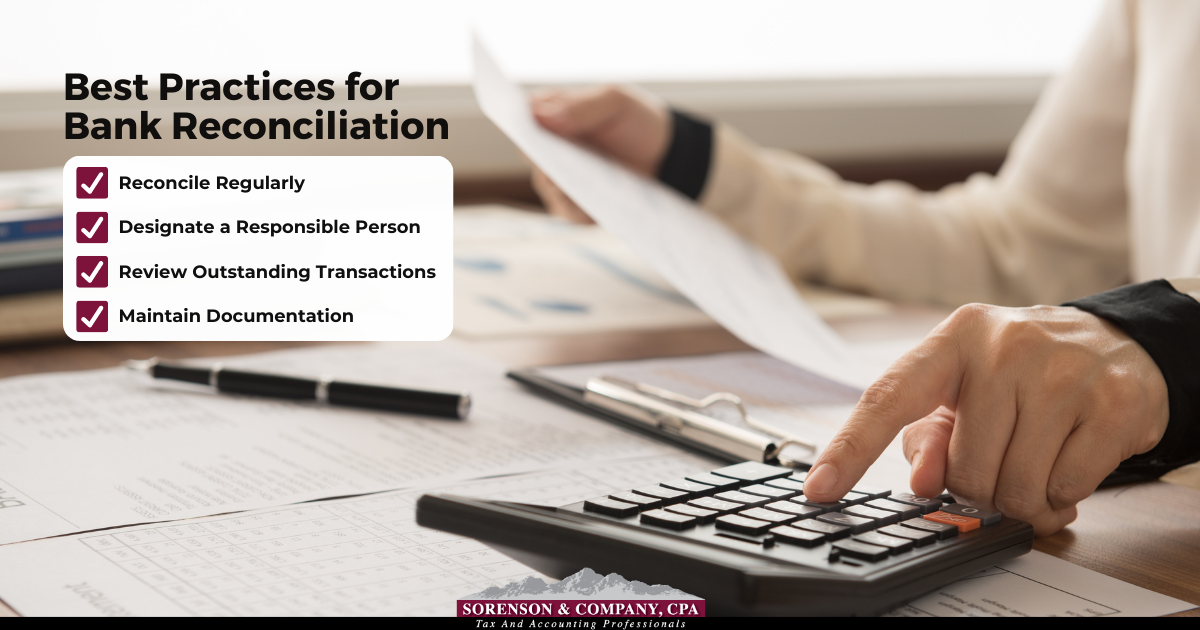

Best Practices for Bank Reconciliation:

- Reconcile Regularly: Aim to reconcile your bank accounts monthly, or even more frequently for high-volume practices. Some bookkeeping software can automate reconciliations and flag anything abnormal which requires a person to double-check.

- Designate a Responsible Person: Assign a specific individual the task of reconciling bank statements to ensure it gets done consistently.

- Review Outstanding Transactions: Investigate any outstanding checks or deposits that haven’t cleared your account by the reconciliation date.

- Maintain Documentation: Keep a record of your reconciliation process, including any adjustments made and explanations for discrepancies.

Medical Bookkeeping Mistake # 3: Lack of Internal Controls

Internal controls are a set of policies and procedures designed to safeguard a company’s assets and ensure accurate financial reporting. In medical bookkeeping, where financial data is sensitive and regulations are complex, robust internal controls are essential.

Risks of Weak Internal Controls

- Financial Losses: Errors and fraud can lead to significant financial losses for medical practices.

- Compliance Issues: Violations of regulations can result in fines, penalties, and reputational damage.

- Operational Inefficiencies: Lack of clear procedures and oversight can lead to wasted time and resources.

Best Practices of Internal Controls for Medical Bookkeeping

- Segregation of Duties: Separate tasks like billing, coding, and check-signing among different staff members reduce the risk of errors or manipulation.

- Dual Authorization: Require two signatures for significant transactions, such as large purchases or checks, adds an extra layer of security.

- Regular Reviews: Regular reviews of financial records and internal controls help identify and address any weaknesses before they become major issues.

- Access Controls: Limiting access to sensitive financial information and computer systems to authorized personnel only helps protect data from unauthorized access.

Medical Bookkeeping Mistake # 4: Not Consulting With Experts

Sorenson & Company, CPA specializes in helping medical practices succeed through improved bookkeeping and accounting practices. Keeping your finances organized is important for your practice’s success and your own peace of mind.

Whether you need help with tax planning, maximizing profitability, saving money, choosing bookkeeping software, training staff, or general practice management, we’re ready to help your team.

Contact us today to avoid mistakes in your practice’s bookkeeping.