Accounting for medical practices is key for healthcare teams to carry out their work effectively. Patient and team care is always the priority. However, without maximizing profitability, the practice’s ability to maintain and improve its services may stall.

Let’s review how to maximize profitability in accounting for medical practices.

Unique Needs of Accounting for Medical Practices

The accounting needs of medical practices are often far more complex than other businesses. Understanding these unique accounting needs will help ensure financial health and sustainability.

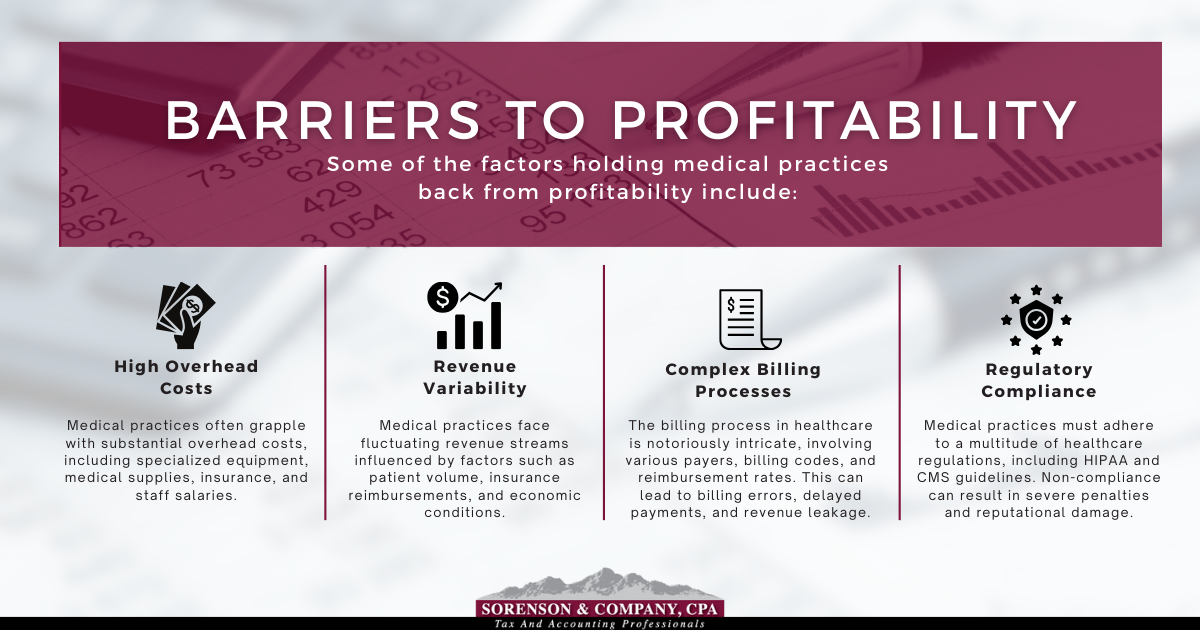

Barriers to Profitability

Some of the factors holding medical practices back from profitability include:

- High Overhead Costs: Medical practices often grapple with substantial overhead costs, including specialized equipment, medical supplies, insurance, and staff salaries.

- Revenue Variability: Medical practices face fluctuating revenue streams influenced by factors such as patient volume, insurance reimbursements, and economic conditions.

- Complex Billing Processes: The billing process in healthcare is notoriously intricate, involving various payers, billing codes, and reimbursement rates. This complexity can lead to billing errors, delayed payments, and revenue leakage.

- Regulatory Compliance: Medical practices must adhere to a multitude of healthcare regulations, including HIPAA (Health Insurance Portability and Accountability Act) and CMS (Centers for Medicare & Medicaid Services) guidelines. Non-compliance can result in severe penalties and reputational damage.

Complexity of Revenue Streams in Accounting for Medical Practices

Receiving medical services isn’t as simple as buying items from a store. Medical practices need to deal with:

- Insurance Reimbursements: Most medical practices rely heavily on reimbursements from private insurance companies, Medicare, and Medicaid. Each payer has its own reimbursement rates, coverage criteria, and claims processing procedures, adding layers of complexity to revenue management.

- Patient Payments: With the rise of high-deductible health plans, patients are shouldering a greater portion of healthcare costs. Managing patient payments, including copays, deductibles, and outstanding balances, requires effective strategies.

- Government Funding: Some practices receive funding from government sources, such as grants, subsidies, or participation in incentive programs like Meaningful Use or MACRA (Medicare Access and CHIP Reauthorization Act).

Accurate Record-Keeping and Compliance

With some businesses, inaccurate record-keeping is simply a headache to deal with at tax time.

In medical practices, there could be severe potential health, financial, and legal repercussions.

Accounting for medical practices requires careful attention to:

- Patient Data Integrity: Accurate record-keeping is fundamental for maintaining patient confidentiality, tracking medical histories, and ensuring continuity of care.

- Billing Accuracy: Precision in billing documentation is crucial for securing timely reimbursements and minimizing revenue cycle inefficiencies. Proper coding, documentation, and submission of claims are vital.

- Compliance with Healthcare Regulations: Medical practices must navigate a complex web of regulatory requirements, spanning privacy, billing, coding, and quality reporting standards.

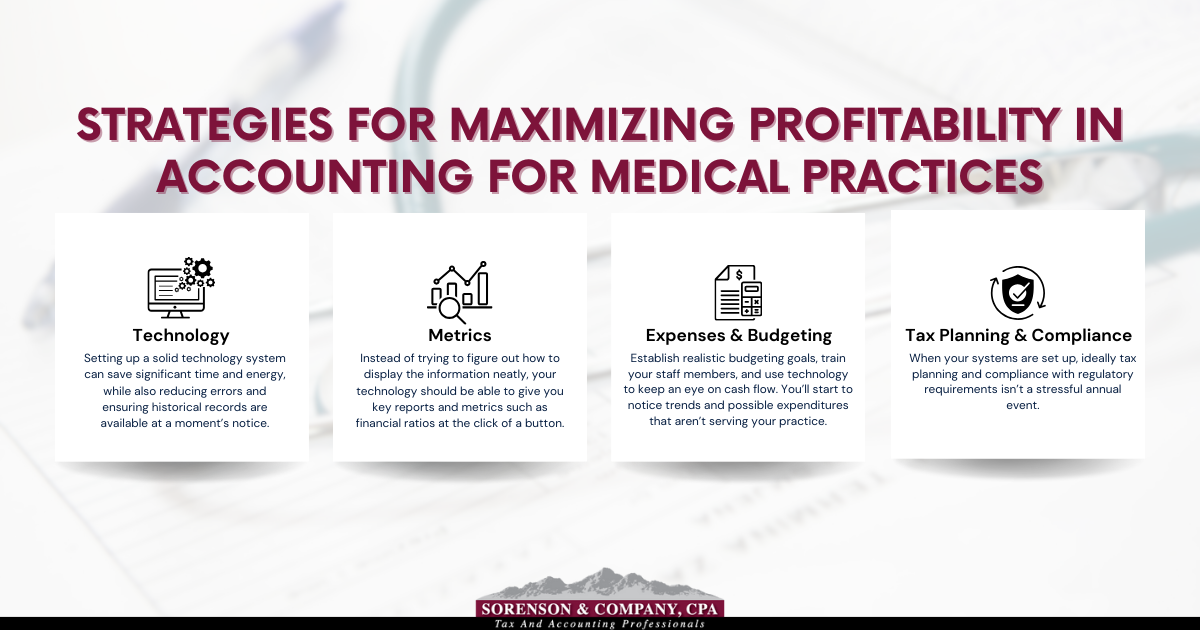

Strategies for Maximizing Profitability in Accounting for Medical Practices

Now that the unique position of medical practices has been explored, consider the following ways to maximize profitability.

Using Technology in Accounting for Medical Practices

Setting up a solid technology system can save significant time and energy, while also reducing errors and ensuring historical records are available at a moment’s notice.

While a practice should never fully rely on technology to solve their problems, it is certainly a helpful starting point.

The right technology can help manage countless aspects of important processes such as accounts receivables, while supporting best practices in medical billing.

If you’re not sure where to start, firms specializing in accounting for medical practices can help you choose, set up, and run your technology solutions.

Analyzing Key Financial Metrics to Identify Opportunities

Now that your technology is well set up, you’re in a strong position to begin analyzing key financial metrics. Instead of trying to figure out how to display the information neatly, your technology should be able to give you key reports and metrics such as financial ratios at the click of a button.

If you’re looking for a refresher on how to read financial statements for medical practices, this article will provide you with the basics.

Medical practices will want to consider financial metrics relevant to the industry, including:

- Revenue per Patient: calculates the average revenue generated per patient visit or encounter. Monitoring changes in revenue per patient over time can indicate shifts in patient demographics, service mix, or pricing strategies.

- Accounts Receivable Turnover: measures how efficiently the practice collects payments from patients and third-party payers. A higher turnover ratio suggests faster collection of receivables and better cash flow management.

- Operating Margin: indicates the percentage of revenue remaining after deducting operating expenses. It reflects the practice’s profitability and operational efficiency.

Managing Expenses with Budgeting

Managing expenses may not sound like a fun task, but taking the time to strategically consider where your revenue is spent can save headaches down the line.

Establish realistic budgeting goals, train your staff members, and use technology to keep an eye on cash flow. When you’ve spent some time doing this regularly, you’ll start to notice trends and possible expenditures that aren’t serving your practice.

Take the time to consider options which are most cost-effective. For example:

- Energy costs: Conduct an energy audit to see where you can save on heating, electricity, and cooling

- Excessive inventory: While it’s good to have extras in cases of emergencies, you might be stockpiling more than is needed for your current practice

- High-cost supplies: Can you take the time to price shop, finding vendors or discounts who are reliable and provide quality products without an unnecessarily high markup?

Tax Planning and Compliance

When your systems are set up, ideally tax planning and compliance with regulatory requirements isn’t a stressful annual event. Tax season planning can be built into the rhythms of the year, allowing your practice to operate with ease.

If you aren’t taking full advantage of tax opportunities, it may be time to find specialists who can help.

Work with Experts in Accounting for Medical Practices

It’s no secret that getting accounting right isn’t the first priority of health medical practices. Luckily, at Sorenson & Company, CPA, simplifying accounting for medical practices is our number one focus.

Get in touch today so we can help maximize your practice’s profitability!